This account is available to 11-17 year olds who are UK residents. 11-15s must apply with a parent or guardian who has an Ulster Bank current account.

We will soon be reducing some of our interest rates, see the changes here.

Features parents and guardians will love

- No monthly account fees.

- Earn 2.35% AER, 2.33% Gross p.a. (variable) interest on balances. Interest is calculated daily and paid monthly.

- There’s no overdraft available on our child and teen bank account.

- Get peace of mind, with protection from the Financial Services Compensation Scheme.

Features teens will love

- Pay your mates via the mobile app (ages 16+).

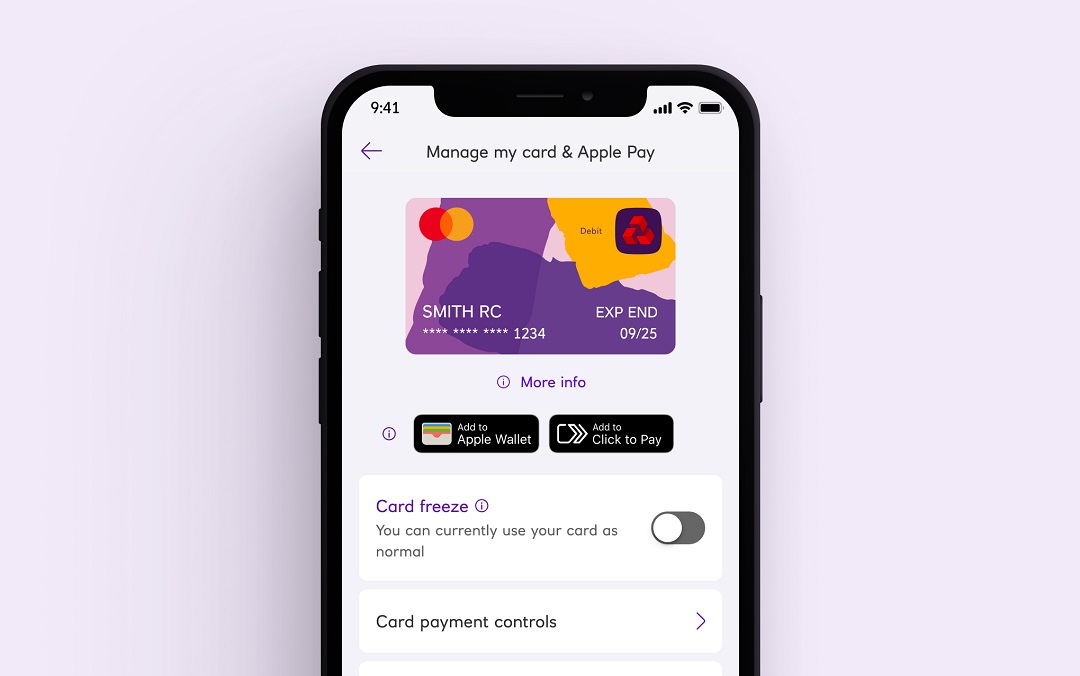

- Freeze and unfreeze your debit card in the app.

- Pay from your phone with Apple Pay and Google Pay™ (ages 13+).

- Earn interest when adding cash to this bank account for teens and kids.

Apple Pay is available on selected Apple devices. You must be aged 13+ to use this service. Google Pay is available on selected Android devices. You must be aged 13+ to use this service. Retailer limits may apply.

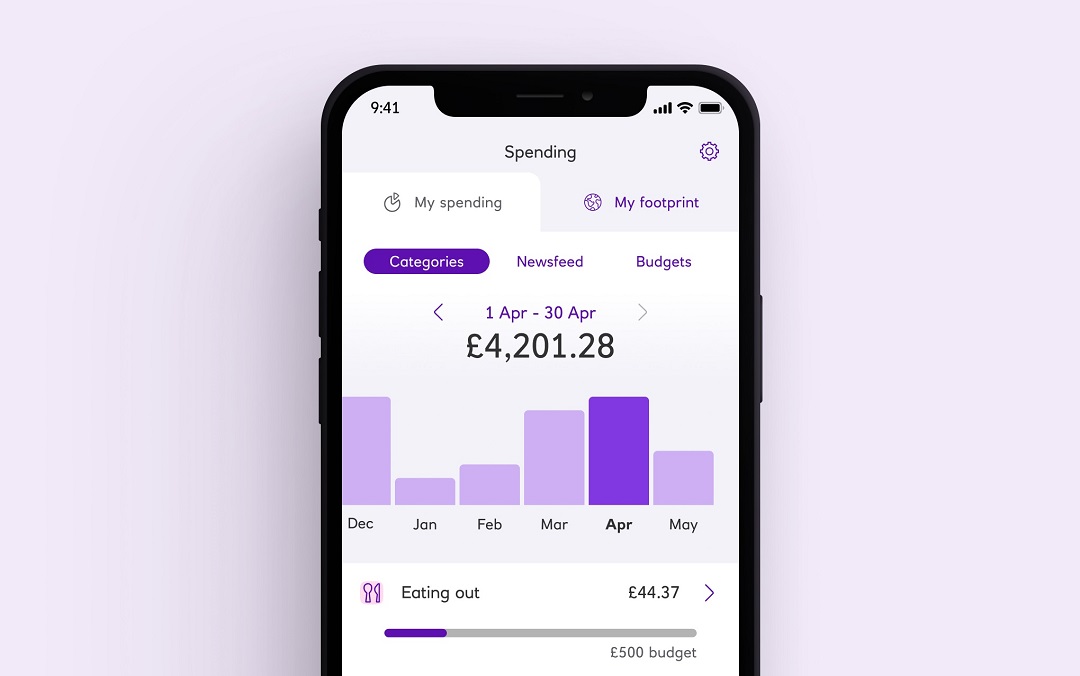

Make banking simple with our mobile app

With our Adapt account, kids and teens can use the same app features as adults. As a parent, you can’t remotely access or control the account. But you could set spending limits for kids aged 15 and under. Want an account with more parental controls? Take a look at our Rooster account. Here are some handy ways to manage your Adapt account via our mobile app.

App available to customers aged 11+ with a compatible iOS and Android devices and a UK or international mobile number in specific countries.

View your under 18 bank account on the go

Check your accounts, balances and recent transactions (things you’ve spent money on). And transfer money between your own accounts.

Get cash without your debit card

Take out up to £130 every 24 hours from our branded cash machines, so long as it’s within your daily withdrawal limit. You must have at least £10 available in your account. And your kids debit card must be active.

Freeze and unfreeze your debit card

Our teen and child bank account comes with a debit card. If you misplace your debit card, you can lock it until you find it. Card lost, stolen or damaged? The quickest way to report this is with our app.

Pay in cheques securely

Use your camera to deposit cheques 24/7 via our mobile app. This feature lets you pay in up to £750 to our child and teen bank account each day. It’s simple, secure and saves you a trip to the branch. Limits apply.

Children aged 11-15: If your parent or guardian banks with us

You need to apply with a parent or guardian who already has an Ulster bank account with us.

When you apply, we'll ask for:

- your proof of ID.

We may also ask for:

- your proof of address if you don't live at the same address as your parent/guardian.

Children aged 11-15: If your parent or guardian doesn't bank with us

To help you open an Adapt account, your parent/guardian must have an existing Ulster bank account.

Once their account is open, you can begin the application with them. We will ask for your proof of ID, plus a proof of address if you don’t live at the same address as your parent/guardian.

Teens aged 16-17: How to open the account yourself

If you’re 16-17, you can apply for your own teen bank account. When you apply online, we’ll only need your proof of ID.

If you don’t have one, you’ll need to apply with a parent or guardian who has a NatWest bank account. We'll ask for your UK birth or adoption certificate as well.

Find out more about proof of ID and proof of address.

If you carry on applying, it means you're happy with what's in these documents, including the FSCS information sheet, and you're happy to view bank statements online, instead of them being posted to you. Please take some time to review, print and/or save the important information

Open a child's bank account online – FAQs

Parents: prefer a pocket money app managed by you?

NatWest Rooster Money comes with a prepaid debit card option from age 6.

- Monitor their spending with limits and alerts.

- Create custom pots for saving money.

- Free Rooster card subscription: for Ulster Bank customers with kids aged 6-17.

T&Cs apply (PDF, 100 KB). Eligibility criteria apply. Card offer includes up to three cards, other fees may apply. Fees apply for non Ulster Bank personal customers.