With the Ulster Bank Adapt account, your kids & teens could get a free child bank account with a debit card and app that helps develop lasting smart spending habits.

We will soon be reducing some of our interest rates, see the changes here.

A little more control at their fingertips

Here are some handy ways to manage your Adapt account via our mobile app.

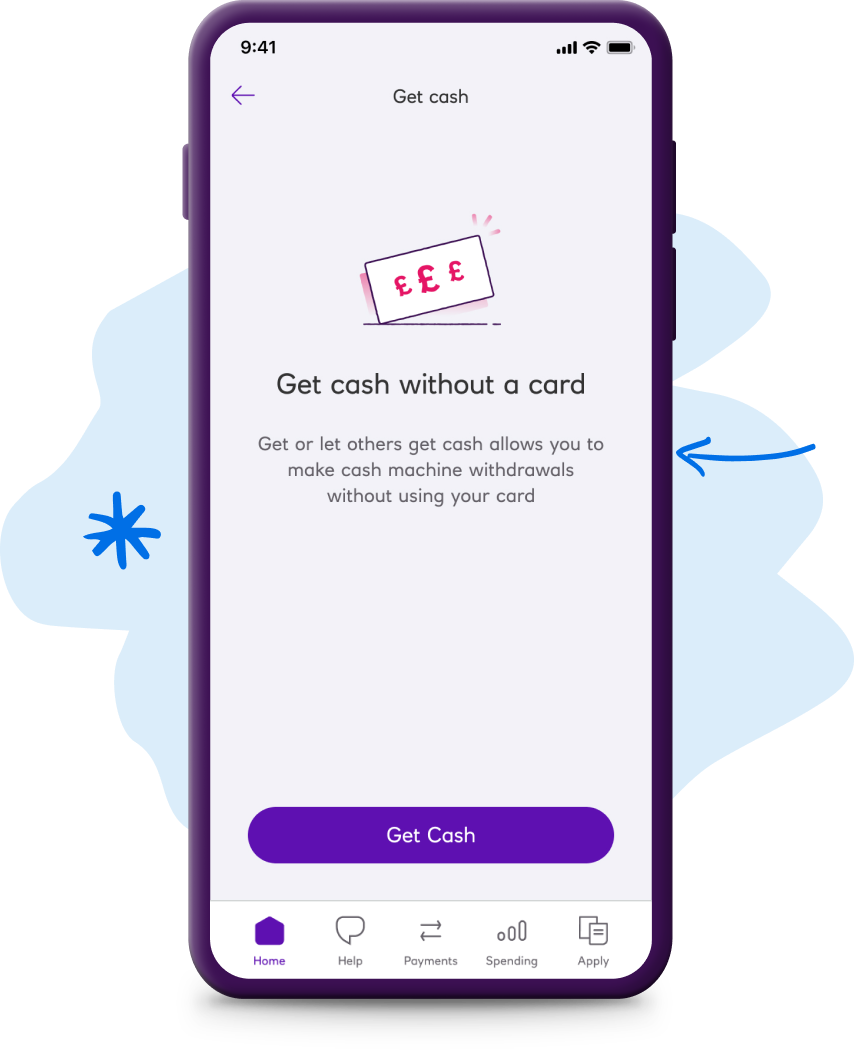

App eligibility criteria apply. For Get Cash without your debit card you must have at least £10 available in your account and debit card must be active.

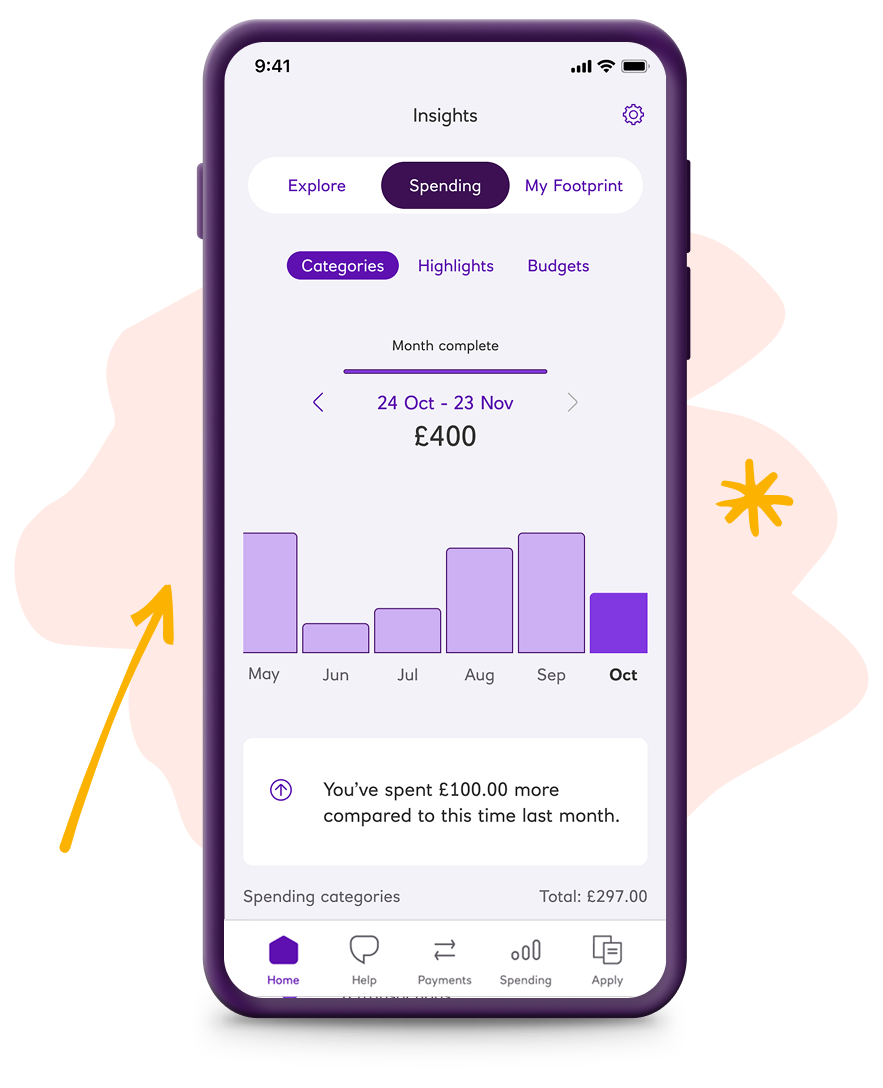

View your under 18 bank account on the go

Check your balance and transactions (things you've spent money on).

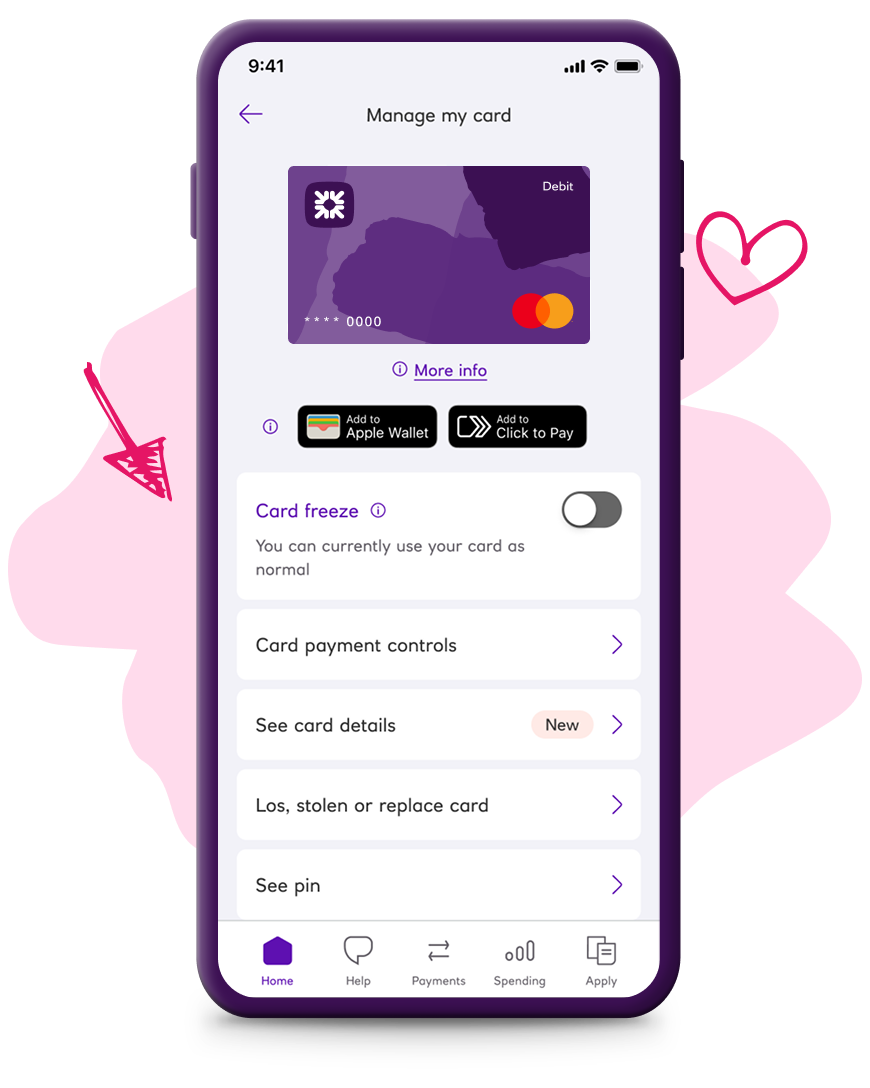

Freeze and unfreeze your debit card

If you misplace your debit card, you can lock it until you find it or report it lost or stolen.

Get Cash without your debit card

Get up to £130 every 24 hours from our cash machines, so long as it’s within your daily withdrawal limit.

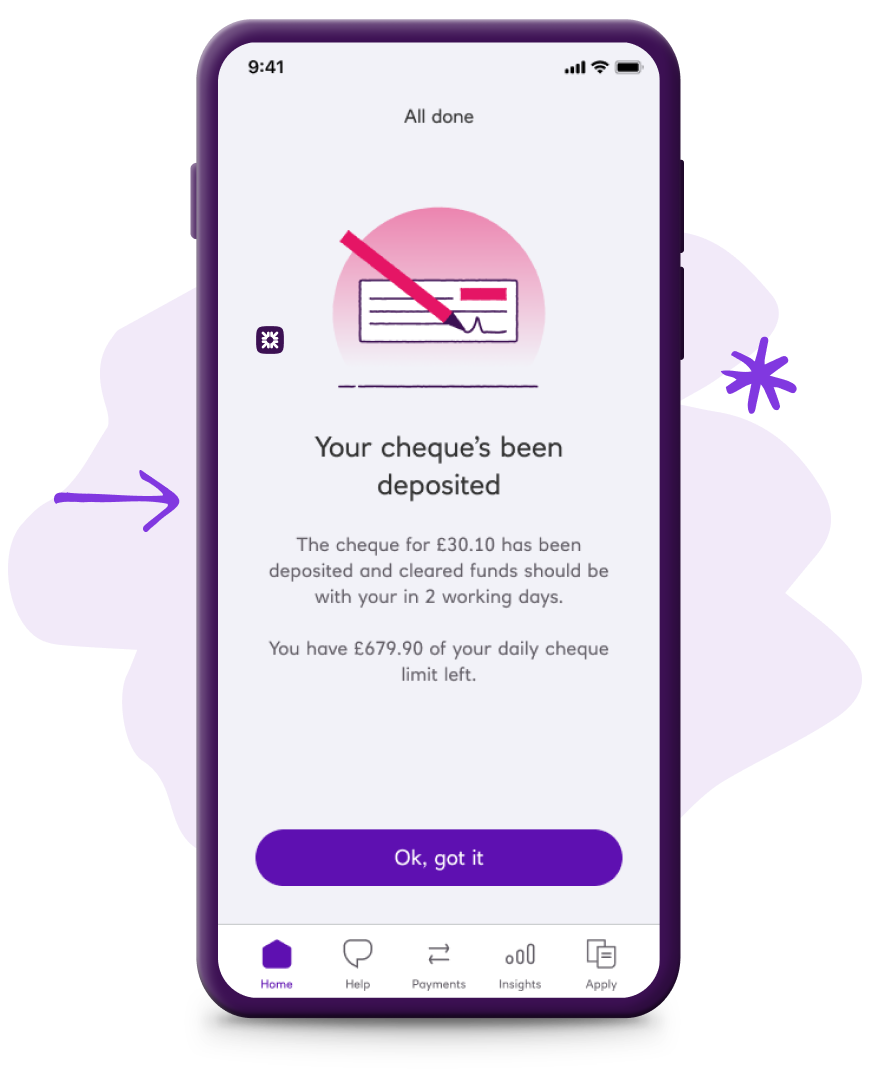

Pay in cheques securely

Use your camera to deposit cheques 24/7 via our mobile app. Limits apply.

A little more control at their fingertips

Here are some handy ways to manage your Adapt account via our mobile app.

App eligibility criteria apply. For Get Cash without your debit card you must have at least £10 available in your account and debit card must be active.

Children aged 11-15: If your parent or guardian banks with us

You need to apply with a parent or guardian who already has an Ulster bank account with us.

When you apply, we'll ask for:

- your proof of ID.

We may also ask for:

- your proof of address if you don't live at the same address as your parent/guardian.

Children aged 11-15: If your parent or guardian doesn't bank with us

To help you open an Adapt account, your parent/guardian must have an existing Ulster bank account.

Once their account is open, you can begin the application with them. We will ask for your proof of ID, plus a proof of address if you don’t live at the same address as your parent/guardian.

Teens aged 16-17: How to open the account yourself

If you’re 16-17, you can apply for your own teen bank account. When you apply online, we’ll only need your proof of ID.

If you don’t have one, you’ll need to apply with a parent or guardian who has a Ulster bank account. We'll ask for your UK birth or adoption certificate as well.

Find out more about proof of ID and proof of address.

FAQs about the Adapt teen and kids' bank account

Children

Rooster Money

The pocket money app that gets children aged 3-17 comfortable with money (while you're still in control).

Teens

Adapt account

Build financial independence for kids aged 11-17 with a kids and teens bank account that earns interest.

Adults

Current accounts

Watch them soar as they graduate to their adult accounts and make important financial decisions.