Pay with your debit card and we'll round up the amount to the nearest pound, then send the spare change to your savings account.

Save little and often and the pennies soon add up. Eligibility criteria and limits apply.

We want to make your financial life as simple as possible, so we’ve gathered all the information for your current account in one place.

Pay with your debit card and we'll round up the amount to the nearest pound, then send the spare change to your savings account.

Save little and often and the pennies soon add up. Eligibility criteria and limits apply.

Withdraw up to £130 every 24 hours from our branded ATMs. You must have at least £10 available in your account and an active debit card.

Simply log in to your app and click on the “Get Cash” icon - you’ll find it at the bottom of the app home screen.

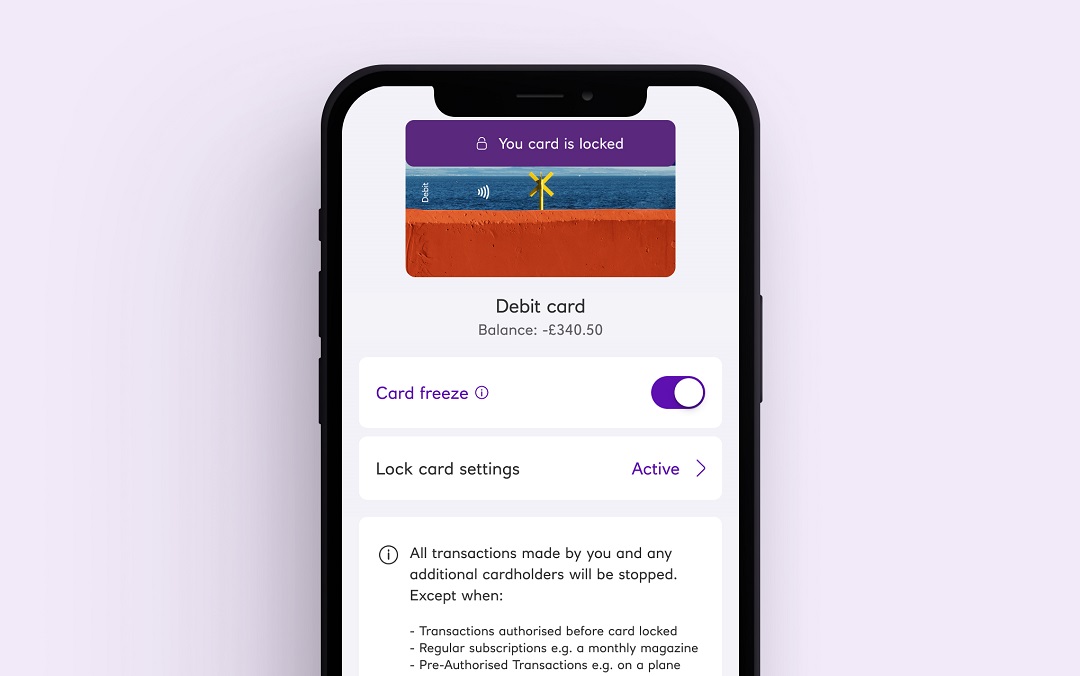

If you've misplaced your debit card, you can freeze it until you find it. Card been lost, stolen, damaged? The quickest way to report this is with our app.

Our app is available to personal and business banking customers aged 11+ using compatible iOS and Android devices. You'll need a UK or international mobile number in specific countries.

Switch a current account held elsewhere to your existing account using the Current Account Switch Service.

Specific account eligibility applies.

Changing your account to a different account

If you'd prefer one of our other accounts, you can change your account online. If you're unsure which account to change to, you can explore our current account range. Follow the steps to 'change your account' from your preferred account page.

Make other changes to your account

You can add or remove an account holder online (terms apply).

Fees apply

The ufirstgold Account comes with a range of benefits including annual worldwide travel insurance and mobile phone insurance. To take advantage of your benefits and get the most from your account, simply visit the ufirst Membership Services. (fees apply)