Explore making a payment

Making a payment

App available to customers aged 11+ with compatible iOS and Android devices and a UK or international mobile number in specific countries. Anytime Banking available to customers aged 11+ with a Ulster Bank account. Biometric approval is available to eligible mobile app customers aged 16 or over.

Payment limits

Account type

Description

Daily limit

Payment type

Frequency

Time taken

Account type

Description

Daily limit

Payment type

Frequency

Time taken

More control of your own payment limit

If you require to make a payment above your current limit then you will need a card reader or your mobile app if you have registered for biometric approval to complete a change of limit to a lower or higher amount.

What you'll need:

- To be registered for Mobile or Anytime Banking

- To be registered for biometric approval if using the Ulster Bank app

Your step by step guide:

-

01

If you require to change your payment limits using Anytime Banking, log in to Anytime Banking, select 'Payments and transfers’, ‘Make a payment or transfer’ then 'Manage my personal payment limits'.

-

02

To change your payment limits using the Ulster Bank app, tap on the ‘Payments’ icon at the bottom of the screen, select ‘Payments settings’ and then ‘Payment limits’.

-

03

Select the limit you wish to amend.

-

04

Select the amount you wish your limit to be set to.

-

05

Select ‘Next’ to navigate to the next page.

-

06

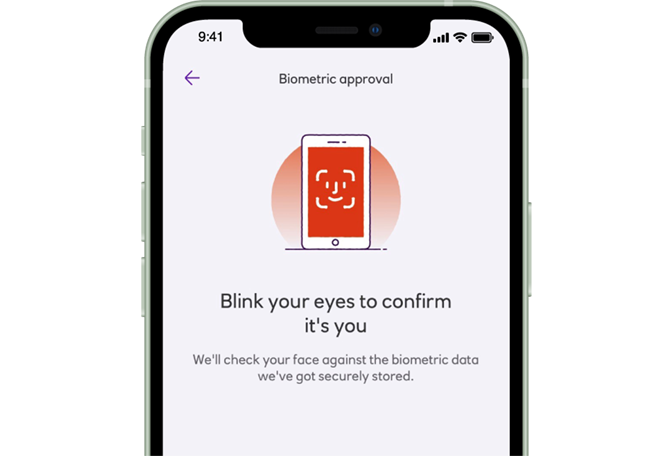

If correct, you will need to use biometric approval to complete the limit change within our app. Please follow the on-screen instructions.

-

07

You will see the limit change confirmation screen. You can now continue with making any payments.

By mobile - what you'll need

Step 1

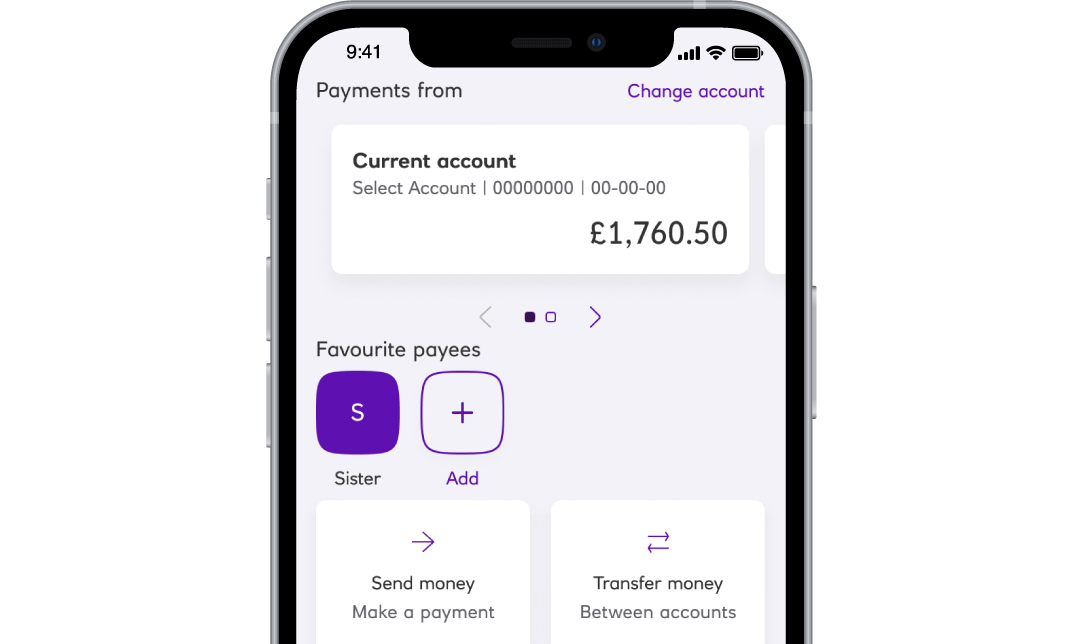

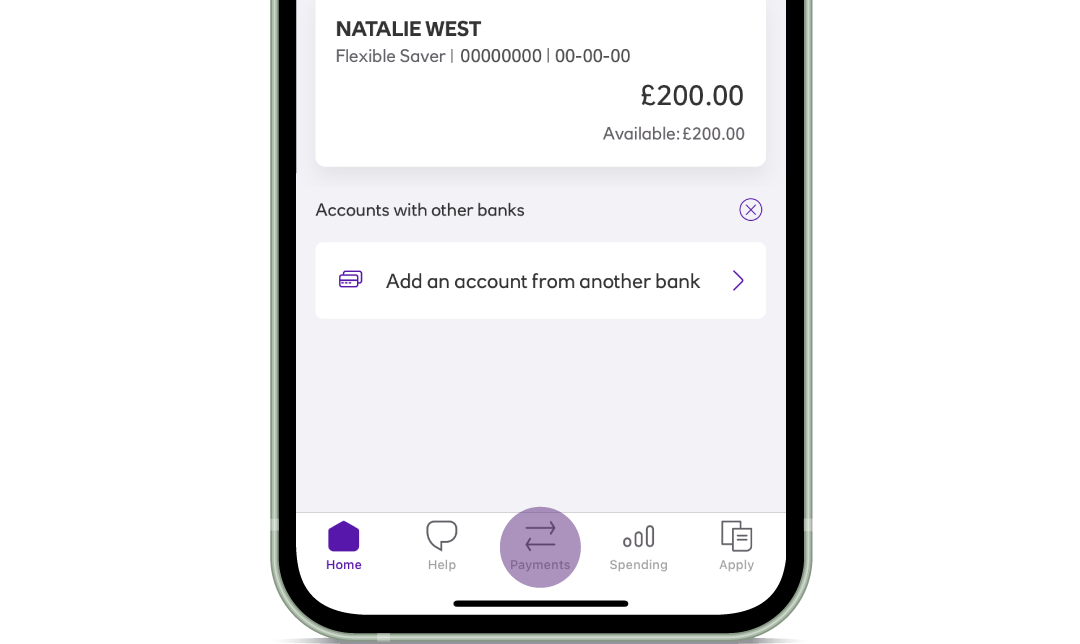

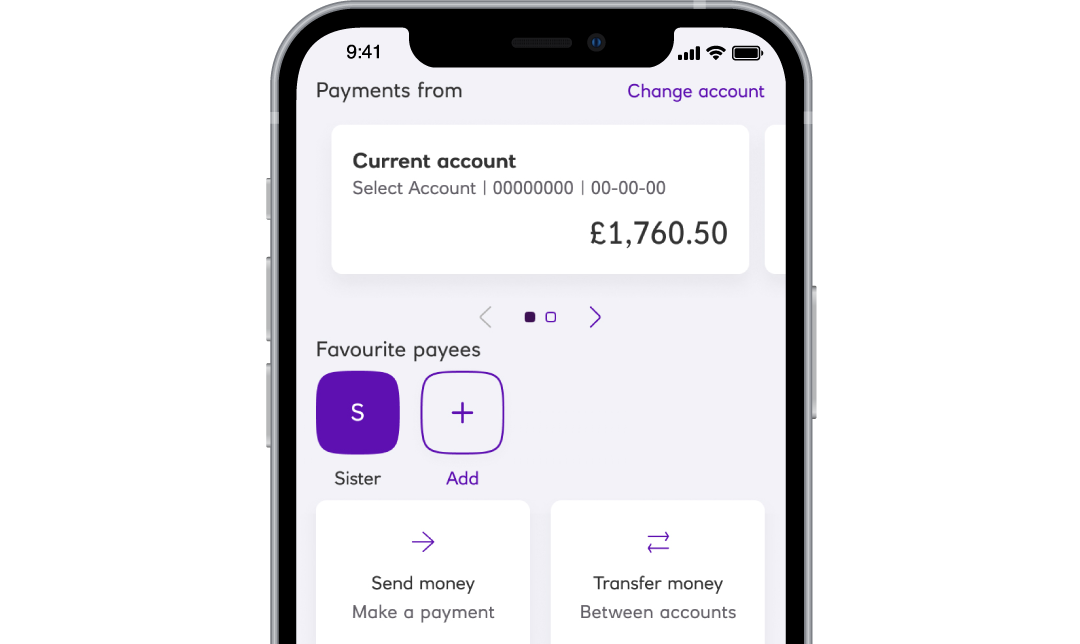

Open the Ulster Bank app and select the ‘Payments’ icon at the bottom of the screen. Make sure you have selected the account you wish to make the payment from.

Step 2

Select ‘Send money’, ‘Make a payment’, then ‘Pay someone new’. Enter the payee’s first and last name, select the account type (Personal or Business), then the account number, sort code and reference details.

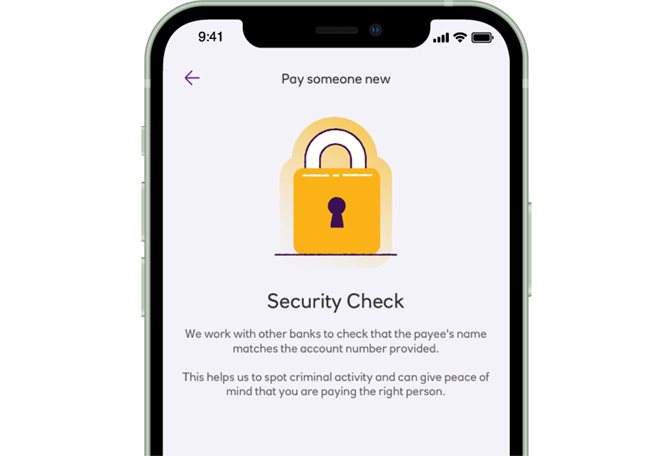

Step 3

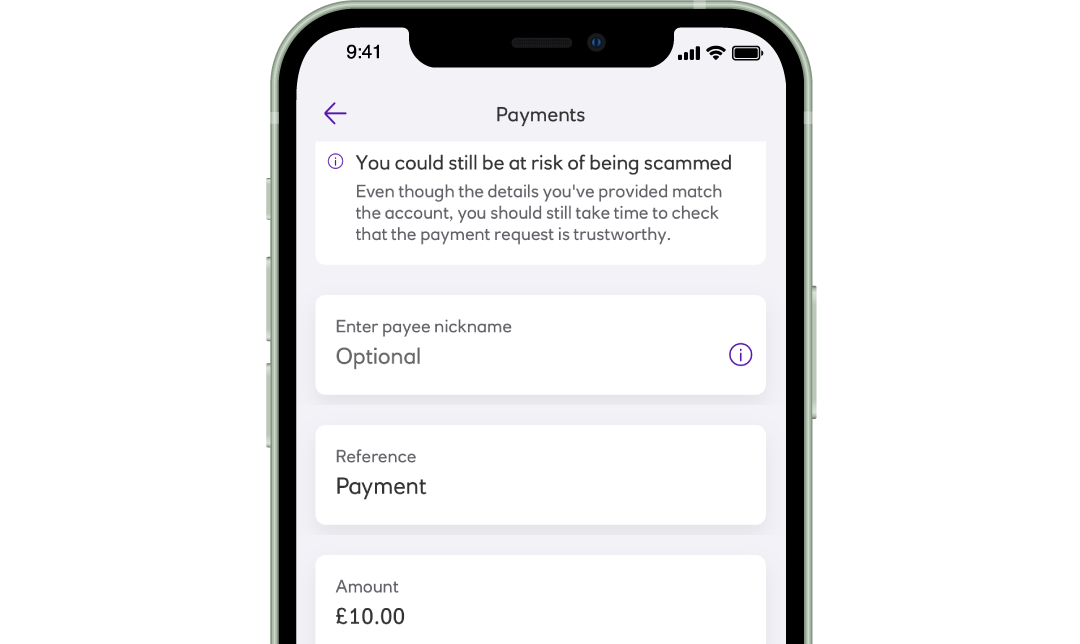

Select ‘Verify payee’ to confirm payee details. Where a Confirmation of Payee (CoP) check is performed you will receive a response to let you know if the name you have entered matches the details for the account. If the response from the payee's bank is ‘close match, no match or unable/unavailable’ we will give you advice on what to do next.

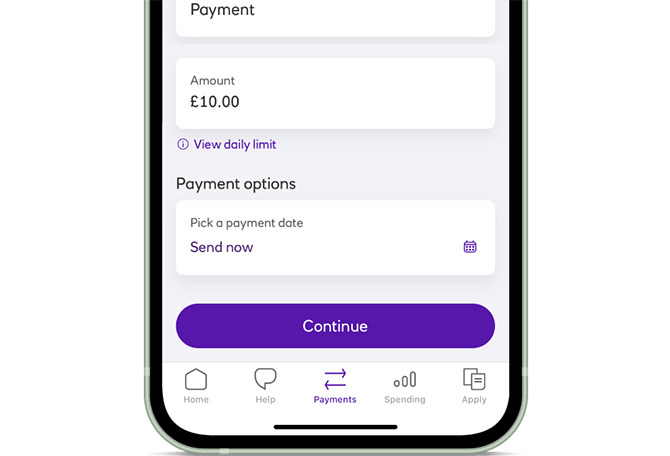

Step 4

Choose the amount you wish to send, add a reference for the payment, a payee nickname (optional), then choose the date you want to send the money on: now or in the future.

Step 5

If you have signed up for biometric approval you will be asked to authorise this payment with your selected biometric. If you have not signed up for biometric approval then you may be asked to authorise this payment. If this happens you will see the ‘Authentication required’ screen. Just tap ‘Next’.

Step 6

Check and confirm the payment details are correct and tap 'Make payment'. That's it, payment made! You can also add this payee to your favourites to make quicker and easier payments to them in the future.

To provide you with extra protection against fraud and scams, you can set your everyday payment limit to an amount that suits you up to a maximum daily amount of £20,000. You will need to be registered for biometrics to change these limits in the app.

To make a higher value payment above this limit, you must be fully verified and be registered for biometrics. You can make 2 higher value payments in 7 days (limited to 1 per day) up to a maximum of 4 in any 28 day period.

If you are not registered for biometrics and you are paying someone new, these payments will be limited to 5 payments a day totalling £750.

App available to customers aged 11+ with compatible iOS and Android devices and a UK or international mobile number in specific countries.

You must be aged 16 or over to send money using Pay Your Contacts.

Online - what you'll need

Step 1

Login to Anytime Banking. Select 'Payments & transfers' from the main menu, choose which account you want to make the payment from, and click on 'Pay someone new'.

Step 2

Type in the first and last name of the payee or the full company trading name (up to 140 characters, acceptable special characters are '/', '&' and '-'). Type in the payee's sort code and account number. Select the account type (Personal or Business).

Step 3

Click next, where a Confirmation of Payee (CoP) check is performed you will receive a response to let you know if the name you have entered matches the details for the account. If the response from the Payee's bank is ‘close match, no match or unable/unavailable’ we will give you advice on what to do next.

Step 4

Review and edit the payee name – the payee name will be prepopulated from the full name you provided but you have the option to edit it. The payee name will appear on your statement and the payee list. Type in a reference - this should be something to help identify you to the payee (up to 18 characters, acceptable special characters are '/', '&' and '-').

Step 5

Click next, enter the amount you wish to pay, then select ‘Pay now’ or ‘Choose a date’ if you want to schedule this payment to leave on a future date. Click next again.

Step 6

Before completing your payment you can review the details entered. If correct you will now need your debit card and card reader or your mobile app if you have registered for biometric approval - follow the on screen instructions. Once completed you will see the payment confirmation and the option to print your transaction.

Anytime Banking available to customers aged 11+ with an Ulster Bank account.

When making the first payment in Anytime Banking, a card reader or your mobile app (if you have registered for biometric approval) will be required. You must be aged 16 or over to send money using Pay Your Contacts.

Step 1

Open the Ulster Bank app and select the ‘Payments’ icon at the bottom of the screen. Make sure you have selected the account you wish to make the payment from.

Step 2

Select ‘Send money’, ‘Make a payment’, then choose who you want to pay from your payee list.

Have your payee saved as a favourite? Just tap the favourite payee and 'Send money' for a quicker way to pay.

Step 3

Choose the amount you wish to send, add a reference for the payment, a payee nickname (optional), then choose the date you want to send the money on: now or in the future. Select ‘Continue’ to review payment details.

Step 4

Check your payment details then select ‘Make payment’. That's it, payment made!

App available to customers aged 11+ with compatible iOS and Android devices and a UK or international mobile number in specific countries.

To provide you with extra protection against fraud and scams, you can set your everyday payment limit to an amount that suits you up to a maximum daily amount of £20,000. You will need to be registered for biometrics to change these limits in the app.

To make a higher value payment above this limit, you must be fully verified and be registered for biometrics. You can make 2 higher value payments in 7 days (limited to 1 per day) up to a maximum of 4 in any 28 day period.

If you are not registered for biometrics, to make a payment from the mobile app for more than £750, you'll need to have made at least one payment to that payee using Anytime Banking.

Step 1

Log in to Anytime Banking. Select 'Payments & transfers' from the main menu, choose which account you want to make the payment from, and from your list of saved payees select the person or company you want to pay.

Step 2

Enter the amount you wish to pay, then select 'Pay now' or 'Choose a date' if you want to schedule this payment to leave on a future date. Click next.

Step 3

Before completing your payment you can review the details entered. Once you have clicked on 'Confirm' you will be shown a summary of your newly arranged payment and you'll also have the option to print your transaction.

Anytime Banking available to customers aged 11+ with an Ulster Bank account.

A daily limit of £20,000 applies when sending money to your saved payees for Personal customers and a daily limit of £50,000 will apply for Premier customers, unless you change your existing reference.

Common questions

Use biometric approval to confirm it's really you

You are your strongest password so why not use your face or voice to approve your everyday banking needs and keep your accounts even more secure.

Biometric approval is available to eligible mobile app customers aged 16+.

Want to send money abroad?

You can make international payments quickly and safely using our mobile banking app or Anytime Banking.

- We don’t charge a fee to send standard international payments using Anytime Banking or the mobile app.

- Live rates, so that you know exactly how much you will pay when making a transaction.

Please be aware, the recipient bank may charge fees for international payments.

Transfer money between your accounts

It's quick and easy using our app or Anytime Banking.